Check FAB Card Balance Online

People now prefer checking their card balances digitally without slotting their cards in the ATM for many reasons. This can be due to the fear of card cloning and security compromises.

Most People enjoy the flexibility of getting the same information from the comfort of their home while a greater number like it for the convenience.

Yours may be one or more reasons above, whatever your reasons are, it’s only wise to learn how to check your FAB card balance without a card slot in.

In this article, I’ll be showing you the step-by-step guide to achieving that.

The FAB Bank

FAB is short for First Abu Dhabi Bank, it’s currently one of the most popular banks in the United Arab Emirates –UAE. FAB is a merger of the National Bank of Abu Dhabi(NBAD) and First Gulf Bank(FGB) in 2017.

As a customer of the FAB, you enjoy multiple financial services including retail banking, corporate banking, wealth management, and investment banking, both in the UAE and internationally.

However, one unsolved question is how to check your FAB Bank balance without an ATM Card.

Step-by-Step Guide How to Check your FAB Card Balance without Card

Here are 3 steps on how to check your FAB balance from the comfort of your home without a card slot:

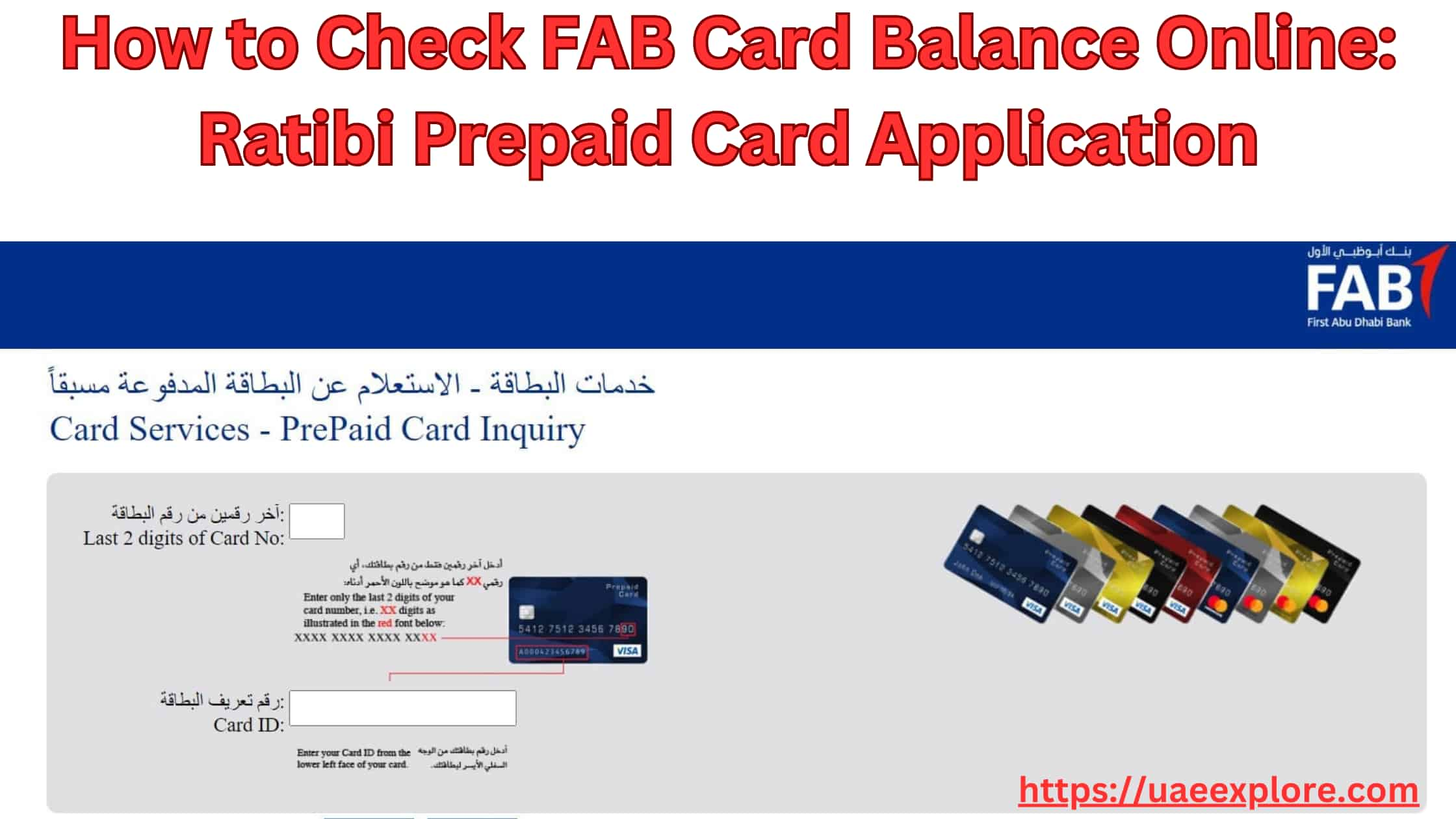

- Visit the FAB Balance Enquiry portal at ppc.bankfab.com.

- You’re to enter only the last 2 digits of your Prepaid card number

- Enter your FAB Card Number

- Click “Go” and your screen will return your account balance and the last 10 transactions you’ve done.

What is a Ratibi Card?

First Ratibi is an Arabic word for Salary, then Ratibi is a card that receives salary from the employer without involving the employee’s FAB Bank account.

You can call it a kind of prepaid card that’s like an account on its own. You can also make purchases with the Ratibi card.

Here are some benefits of the Ratibi card:

- Activation isn’t required–it’s issued by employers or government agencies for wages and salary pay.

- You don’t have to worry about the minimum balance provision.

- You don’t need a bank account for it.

- You have 24/7 customer support

- You can utilize ATMs to set the cardholder’s personal ‘PIN.’

- You get free personal accident insurance.

How to Open An Online Account with FAB

The manual told me that opening an account can be time-consuming and stressful, although the best, but people may have so much time to spare. If you’re in the nick of time, feel free to attempt these steps for Opening an account with FAB online:

- Must have a FAB account.

- Visit the FAB website

- At the topmost right select the drop menu, you’ll see numerous items, select Account

- Inside Account, select the type of account that you want to open.

- Fill in the data entries and upload the required documents.

- Submit the data entry and you’re done

- Wait for the feedback on how to go about card activation.

Eligibility Requirements to Open an Online Account with FAB

The 13 account option on the FAB platform has unique requirements to open, however, there are the general must-haves of the FAB bank as enforced by the authorities.

Below are what you should consider before taking if FAB account online:

- Proof of Identification: You must provide a valid proof of Identification, and of the following will do an Emirates ID card or other government-issued ID.

- Your Residency Status: You should show your residence visa or other documents as permitted.

- At least 18 years of age: You can proceed with the idea of opening an FAB account if you’re at least 18 years old.

- Legit source of Income: Get ready, your source of income must be law-abiding. That’s via Employment, entrepreneurship etc.

- Proof of Address: You should be traceable in case the need arises. Of course, you have to be in the UAE to qualify for the service.

- Minimum Deposit: While the Ratibi card doesn’t demand a minimum deposit, the actual bank does. Here, FAB demands that you make an initial deposit depending on the type of account.

Eligibility and Application Guide for Ratibi Prepaid Card

You can get your payment as an employee by having a Bank account with FAB. However, this is possible when you meet these 2 requirements.

- You must be a resident in the UAE, whether permanent or visitor.

- Your KYC-Know Your Customer information must be up to date.

How to Apply for the Ratibi Prepaid Card

- Fill out your details and the application form.

- Complete the iBanking application form for access to the digital card.

- The application should be channeled to the nearest FAB branch near you.

FAQs of FAB Bank Balance Online

What service will I get by banking with FAB?

Multiple account choice: You have about 13 account types to choose from.

Faster Transfer within FAB – You easily transfer funds between FAB customers and accounts in one click.

Virtual Transfer – Pay virtually and at ease anywhere in the world. These are hand-picked, and numerous goodies are awaiting you when you bank with FAB.

Do I need an FAB account to use the Ratibi Prepaid Card?

Yes, you need to have an FAB account to get the Ratibi card, however, you do not need the FAB account for payment transmission, as payment can be transferred from employers to the worker directly.

What documents are required to Open the FAB online account?

Here are a highlight of the documents that you need:

Proof of identification,

Residential status, etc.

Conclusion | FAB Balance Online

Digital banking is a game changer as it allows you to experience round-the-clock banking services like checking balances and sending and receiving payments.

Banking with FAB exposes you to great banking and financial benefits such as exposure to international banking, 24/7 customer support, fair loan offers and amongst others financial security.

You can effectively oversee your financial matters by utilizing a detailed Zintego bill https://www.zintego.com and monitoring your National Bank of Abu Dhabi (NBAD) account balance.

Opening an online account with FAB is as simple as visiting the FAB website, choosing the account you wish to open, filling out the form and uploading documents. Happy banking.

Read Also: How To Check Your Emirates ID Fines